Strong Advice For Getting The most Out Of Credit score Playing cards

Struggling with debt from credit score cards is something that almost everyone has dealt with sooner or later. Whether or not you are attempting to enhance your credit score normally, or remove yourself from a troublesome financial state of affairs, this text is bound to have tips that may show you how to out with credit cards.

Do not accept the primary credit card offer that you just obtain, no matter how good it sounds. While you may be tempted to jump on a proposal, you don't want to take any probabilities that you'll find yourself signing up for a card and then, seeing a better deal shortly after from one other company.

It is best to try to pay your bank card balance off monthly. Generally, it's best to use credit cards as a pass-by, and pay them earlier than the next billing cycle starts, instead of as a excessive-interest loan. When you keep balances off your cards, you avoid curiosity and other finance fees. Making use of the playing cards helps build up your credit score, too.

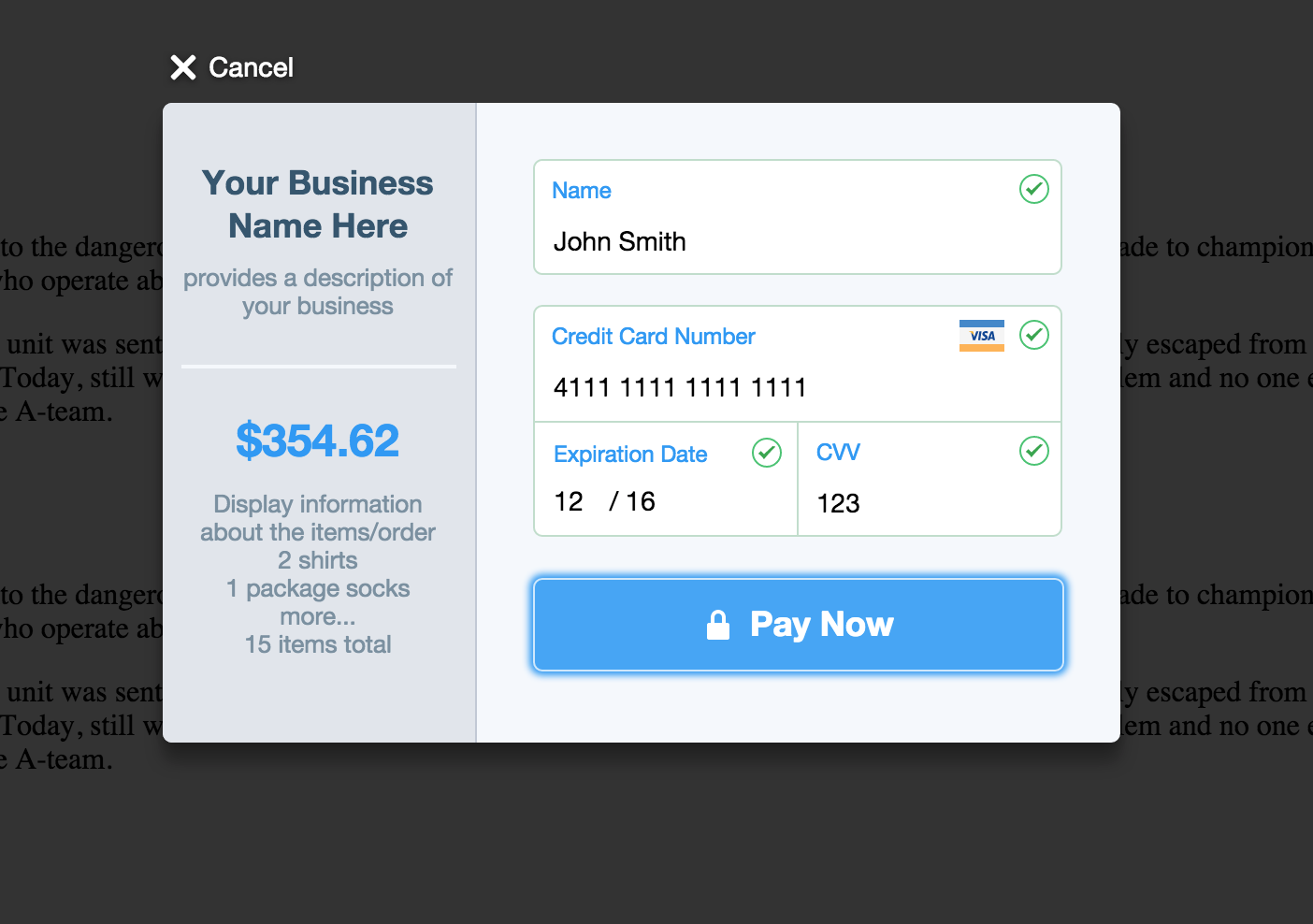

Never give out your credit card quantity to anyone, until you are the person that has initiated the transaction. If somebody calls you on the phone asking on your card quantity to be able to pay for anything, it's best to ask them to provide you with a strategy to contact them, so to arrange the fee at a greater time.

When you have several credit score cards with balances on every, consider transferring your entire balances to one, lower-curiosity credit card. Virtually everybody gets mail from various banks offering low or even zero stability credit playing cards in case you switch your current balances. These decrease interest charges usually final for six months or a yr. click the up coming document can save loads of interest and have one decrease cost each month!

As a common rule, you need to avoid applying for any credit cards that include any sort of free provide. simply click the up coming webpage of the time, something that you just get free with bank card purposes will all the time include some form of catch or hidden prices that you are certain to remorse later on down the street.

If you are going to make purchases over the Internet it's essential make all of them with the identical bank card. You don't want to use your whole cards to make online purchases because that can increase the possibilities of you becoming a victim of credit card fraud.

Attempt establishing a month-to-month, computerized payment in your credit score playing cards, so as to keep away from late fees. The amount you need in your cost will be mechanically withdrawn from your bank account and it'll take the worry out of getting your monthly payment in on time. go to this website may save money on stamps!

You possibly can request a free annual credit score report to ensure all the knowledge on it is correct. Be sure that your report matches up with the statements you might have.

Do your research on the most effective rewards cards. Whether or not you're concerned with cash again, gifts, or airline miles, there is a rewards card that may actually benefit you. There are various on the market, but there's a lot of information accessible online to assist you find the suitable one. Be careful to not carry a stability on these rewards playing cards, as the interest you're paying can negate the positive rewards impact!

Keep pop over to this site on transactions made together with your credit card. You could possibly get alerts despatched right to your cell phone about your credit card. This may permit you to immediately be aware of any irregular activity taking place in your card. For those who discover suspicious exercise in your account, you must contact your financial institution immediately, and if you must, come up with the police.

Should you owe money to your bank card company and you cannot afford to pay it, contact your company. You might be able to arrange a hardship plan until you'll be able to pay the money back. This way, you can avoid getting into debt and ruining your credit.

Strive your greatest to make use of a prepaid bank card when you make on-line transactions. It will help so that you don't have to worry about any thieves accessing your actual bank card information. Will probably be a lot easier to bounce again if you're scammed in the sort of scenario.

Be wary of signing up for credit cards for all the improper causes. Yes, sufficient miles for an unbelievable vacation sounds terrific, however do you really need that further card? You could discover the curiosity you pay on that card, particularly when it's maxed out, pays for that journey a number of occasions over.

Avoid corporations that ask for money upfront so as to get a card. Official credit score firms do not cost charges beforehand. Also be sure you're not giving a person money to help you in getting a card. You probably have a great credit history, you'll get authorised for credit score without any help.

If you occur to lose or misplace your credit card, make sure you name the corporate that you got your card from. This enables that firm to close that card, so that nobody can use it. Your credit card firm will instantly subject you a brand new bank card and number.

Don't lower up all of your playing cards thinking that may finish your debt woes. It's true that stopping the bleeding is step one, you continue to have to pay down the payments. It is healthier to get within the habit of simply paying off your full steadiness every month. Having active revolving debt will boost your credit score rating, and give you decrease curiosity rates, which actually helps paying down your debt.

After studying Going in %url_domain% , you should feel higher ready to deal with all types of credit card conditions. If you properly inform yourself, you don't need to worry credit any longer. Credit score is a tool, not a prison, and it ought to be utilized in simply such a manner always.